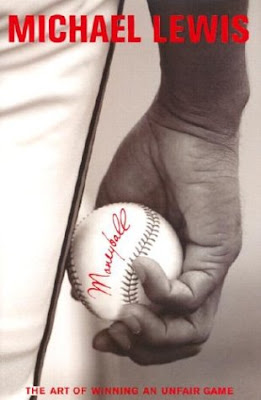

Have y'all read Moneyball by Michael Lewis?

I finally worked it into my busy reading schedule. I was sitting around a family member's house with nothing to do and grabbed it off a book shelf. It won't take you more than a couple of days to read this thought-provoking book.

In my opinion, it's only incidentally about baseball. Here's some of Wikipedia's synopsis:

The central premise of Moneyball is that the collected wisdom of baseball insiders (including players, managers, coaches, scouts and the front office) over the past century is subjective and often flawed. Statistics such as stolen bases, runs batted in, and batting average, typically used to gauge players, are relics of a 19th-century view of the game and the statistics that were available at the time.

Since then, real statistical analysis has shown that on base percentage and slugging percentage are better indicators of offensive success and that avoiding an out is more important than getting a hit. Every on-field play can be evaluated in terms of expected runs contributed. For example, a strike on the first pitch of an at-bat may be worth - 0.05 runs. This flies in the face of conventional baseball wisdom and the beliefs of many scouts who are paid large sums to evaluate talent.

By re-evaluating the strategies that produce wins on the field, the 2002 Athletics, with approximately $41 million in salary, are competitive with larger market teams such as the New York Yankees and Boston Red Sox, who spend over $100 million in payroll. Oakland is forced to find players undervalued by the market, and their system for finding value in undervalued players has proven itself thus far - except, of course, in the playoffs.

Several Lewis themes explored in the book include: insiders vs. outsiders (established traditionalists vs. upstart proponents of Sabermetrics), the democratization of information causing a flattening of hierarchies, and the ruthless drive for efficiency that capitalism demands. The book also touches on Oakland's need to stay ahead of the curve; as other teams begin mirroring Beane's strategies to evaluate offensive talent, diminishing the Athletics' advantage, Oakland begins looking for other undervalued baseball skills such as defensive capabilities.

That little summary barely does the book justice so let me elaborate.

Consider the sacrifice bunt. For a hundred years baseball managers have been employing it to manufacture run(s). It turns out that statistically, it decreases a team's chance of scoring. Nobody had ever tested this century-old conventional wisdom until recently. Once these baseball geeks (Bill James, et al) started scientifically studying the numbers, all sorts of baseball truisms got thrown out the window. There's plenty more I could say about this book but I want to move on.

Dave Pelz did for golf what Sabermetricians did for baseball. Pelz, about 20 years ago, started following around pro golfers with a notebook and a measuring tape. He began gauging golf performance in entirely new ways. He too challenged century-old conventional wisdom with a novel scientific approach. Do you know whether it's more important to hit your putts solidly or on-line? Is a full wedge really easier to stick than an in-between 65 yard shot? Dave had not only the necessary passion (opting for relative poverty) but also the tools for this undertaking; he had a PhD in Physics and experience working for NASA. Any golfer who rejects Pelz's teachings - and I have met plenty of them - is essentially rejecting pure science. His premiere acolytes today are Phil Mickelson and Vijay Singh; but what the heck do they know with their combined six major championships?

The last field I want to talk about is my business - securities trading. While there are countless qualified examples, I want to mention two companies: Timberhill (Interactive Brokers) and Susquehanna Investment Group. Both burst on the scene in the past 20-30 years as highly innovative, paradigm-uprooting trading firms. Both were pioneers in arbitrage and in incorporating the latest technology. They threw out the "tape-reading", pit fighting, chart-reading, and rumor-chasing strategies of yesteryear and built massive fortunes around game theory and the quantitative modeling of MIT geeks. They filtered out all the noise and whittled their bets down to only those that made mathematical and empirical sense. If only I could figure out how!!!

Take a peek at this pic of a Susquehanna recruitment stand.

They certainly don't look like the 'Old Boys Club' from Wall Street. Now, care to hazard a guess at which one is most likely from Human Resources?

Heck, at Google - another modern day paradigm-shifter - you're not even allowed to make a suggestion at a meeting that starts with, "I think...." Instead, one must preface their suggestions with "The data suggests..."

All of my examples highlight the success redounding to brave souls who challenged conventional wisdom.

I'll tell you what. If you take a good look in the mirror, catalog all your firmly held beliefs, and set out to test them...if you do this honestly you'll be quite surprised at the results. Just do it. Give your mind the enema it so desperately needs. We clean out every other part of the body, do we not?

And if you need help recognizing your flaws, just shoot me an email on the side and I will get you started.

2 comments:

Yes, I started putting side-saddle with a long putter after reading a few kind words Pelz had to say on the topic (among other reasons). I probably putt marginally better this way than the conventional way, albeit looking crazy while I do it.

The funny thing is, you are not being deliberately ironic...

Hilarious indeed!

Post a Comment